IR

To our Shareholders and Investors

IR LIBRARY

- August 31, 2024Results of Operations for the Fiscal Year Ended August 31, 2024

- August 31, 2024Summary of Consolidated Financial Results for the Fiscal Year Ended August 31, 2024

- July 12, 2024Results of Operations for the Third Quarter of the Fiscal Year Ended August 31, 2024

- July 12, 2024Summary of Consolidated Financial Results for the Third Quarter of the Fiscal Year Ending August 31, 2024

- April 26, 2024Results of Operations for the First Half of the Fiscal Year Ended August 31, 2024

- April 12, 2024Summary of Consolidated Financial Results for the Second Quarter of the Fiscal Year Ending August 31, 2024

- January 23, 2024Results of Operations for the First Quarter of the Fiscal Year Ended August 31, 2024

- January 12, 2024Summary of Consolidated Financial Results for the First Quarter of the Fiscal Year Ending August 31, 2024

- October 26, 2023Results of Operations for the Fiscal Year Ended August 31, 2023

- October 13, 2023Summary of Consolidated Financial Results for the Fiscal Year Ended August 31, 2023

- July 31, 2023Results of Operations for the Third Quarter of the Fiscal Year Ended August 31, 2023

- July 14, 2023Summary of Consolidated Financial Results for the Third Quarter of the Fiscal Year Ending August 31, 2023

- April 27, 2023Results of Operations for the First Half of the Fiscal Year Ended August 31, 2023

- April 14, 2023Summary of Consolidated Financial Results for the Second Quarter of the Fiscal Year Ending August 31, 2023

- January 30, 2023Results of Operations for the First Quarter of the Fiscal Year Ended August 31, 2023

- January 13, 2023Summary of Consolidated Financial Results for the First Quarter of the Fiscal Year Ending August 31, 2023

- October 31, 2022Results of Operations for the Fiscal Year Ended August 31, 2022

- October 19, 2022Summary of Consolidated Financial Results for the Fiscal Year Ended August 31, 2022

- August 5, 2022Results of Operations for the First Nine Months of the Fiscal Year Ended August 31 2022

- July 14, 2022SERAKU_Summary of Consolidated Financial Results for the Third Quarter of the Fiscal Year Ending August 31, 2022

- May 25, 2022SERAKU's Growth Strategy for Taking on Change

- April 26, 2022Results of Operations for the First Half of the Fiscal Year Ended August 31, 2022

- April 13, 2022SERAKU_Summary of Consolidated Financial Results for the Second Quarter of the Fiscal Year Ending August 31, 2022

- January 28, 2022Results of Operations for the First Quarter of the Fiscal Year Ended August 31, 2022

- January 24, 2022SERAKU_Summary of Consolidated Financial Results for the First Quarter of the Fiscal Year Ended August 31, 2022

- October 15,2021SERAKU_Summary of Consolidated Financial Results for the Fiscal Year Ended August 31, 2021

- August 3, 2021Results of Operations for the Third Quarter of the Fiscal Year Ending August 31, 20211

- July 14, 2021SERAKU_Summary of Consolidated Financial Results for the Third Quarter of the Fiscal Year Ending August 31, 2021

- May 6, 2021Results of Operations for the First Half of the Fiscal Year Ending August 31, 2021

- April 14, 2021Announcement of Dividend Payments Linked to Results of Operations

- April 13, 2021SERAKU_Summary of Consolidated Financial Results for the Second Quarter of the Fiscal Year Ending August 31, 2021

- February 3rd, 2021SERAKU_Summary of Consolidated Financial Results for the First Quarter of the Fiscal Year Ending August 31, 2021

- November 20th, 2020SERAKU_Summary of Consolidated Financial Results for the Fiscal Year Ended August 31, 2020

- November 20th, 2020Results of Operations for the Fiscal Year Ended August 31,2020

FINANCIAL INFORMATION

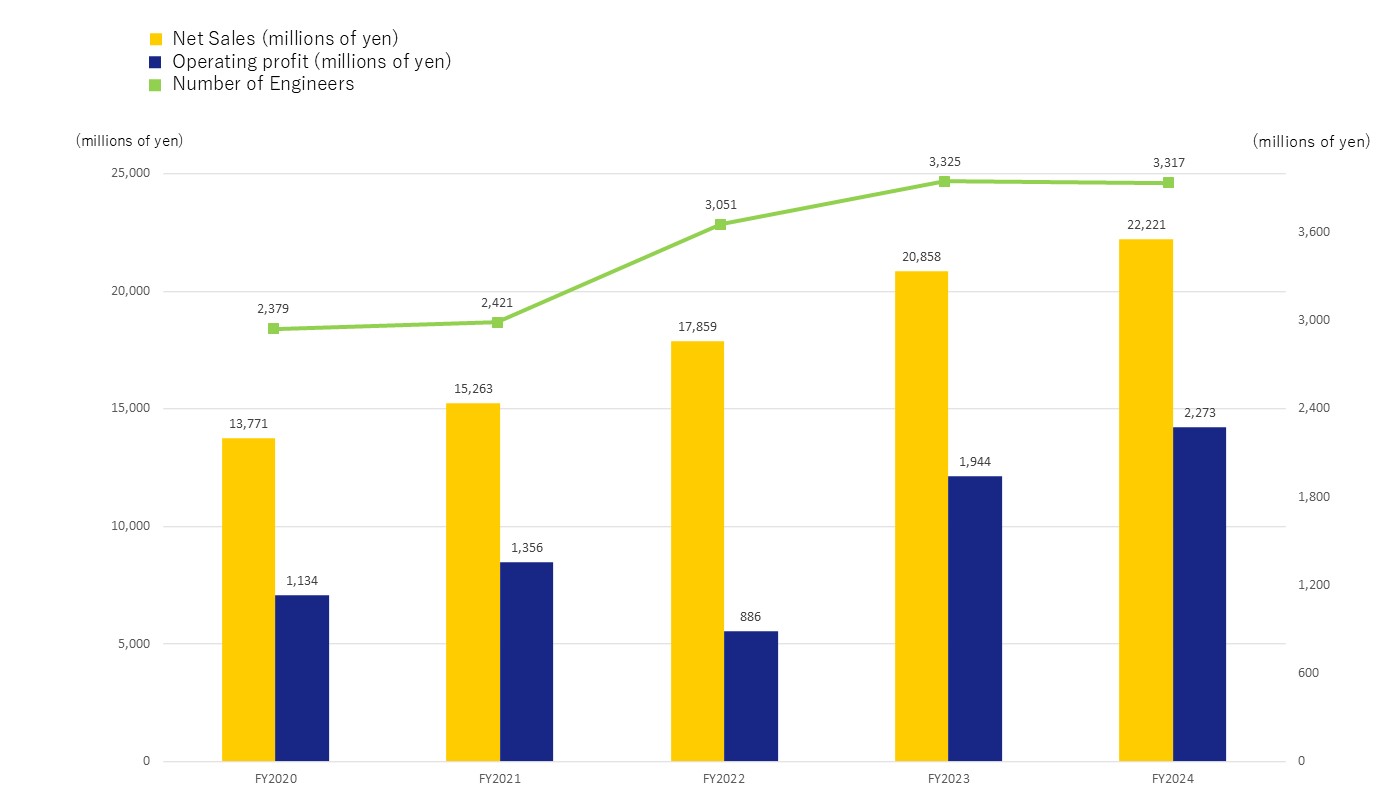

Five-year Summary

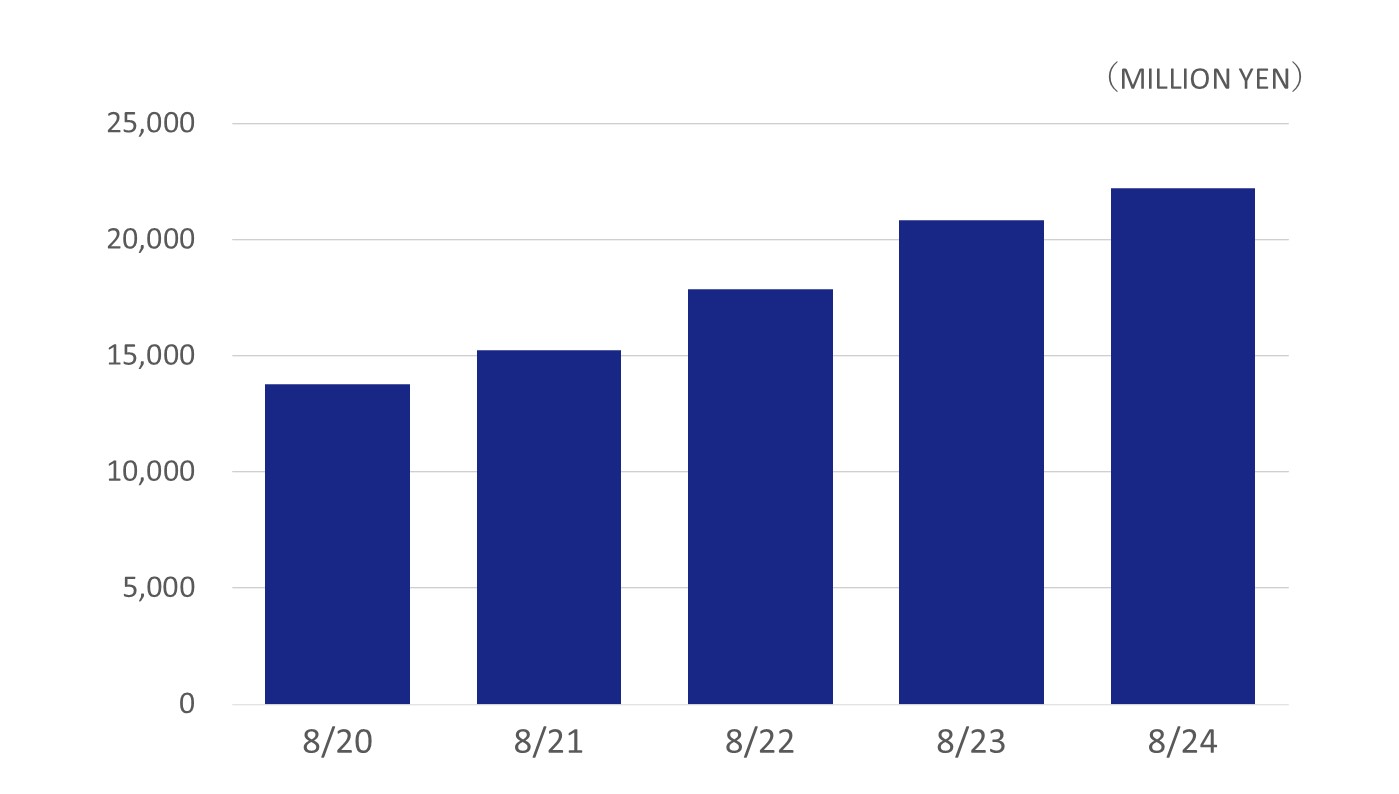

Revenue

| 8/19 | 8/20 | 8/21 | 8/22 | 8/23 |

|---|---|---|---|---|

| 11,410 | 13,771 | 15,263 | 17,859 | 20,858 |

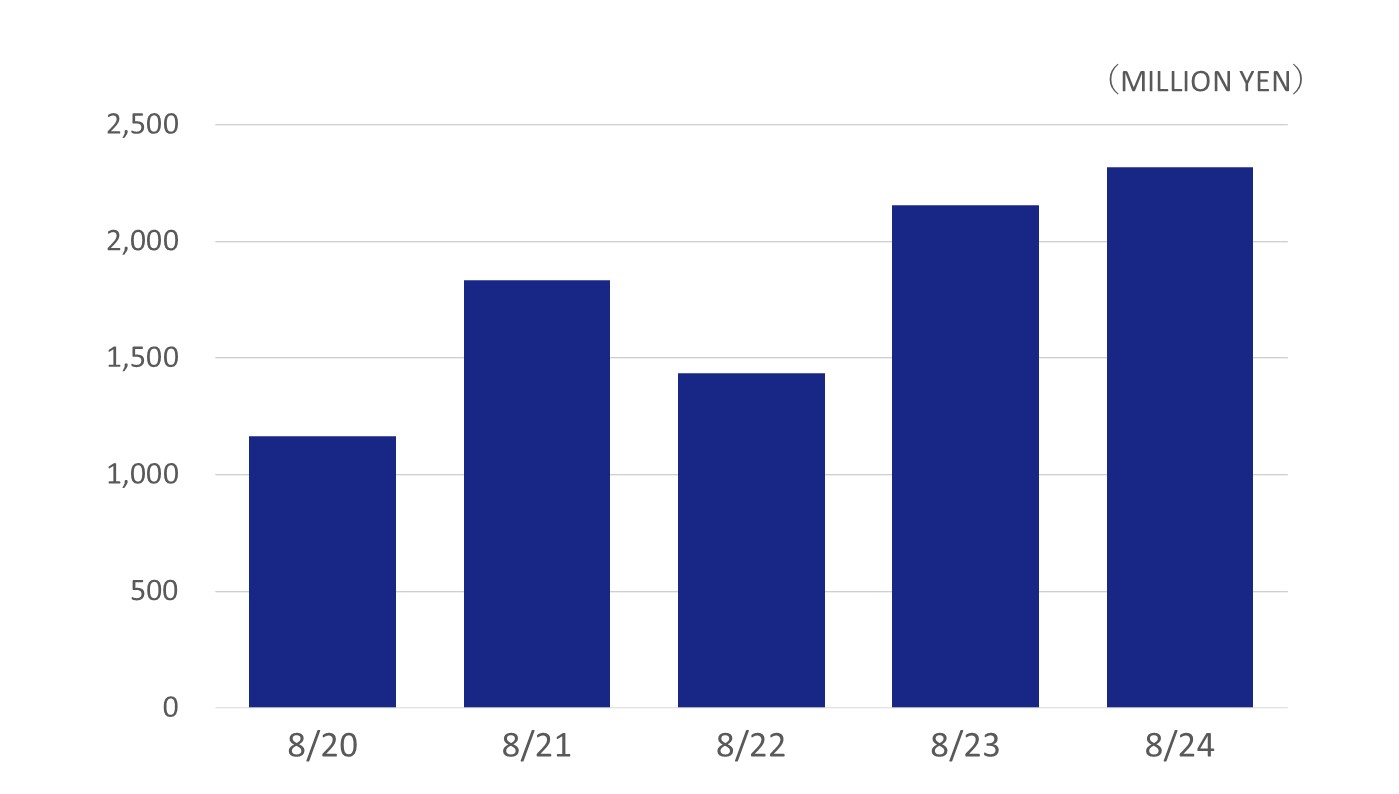

Ordinary income

| 8/19 | 8/20 | 8/21 | 8/22 | 8/23 |

|---|---|---|---|---|

| 737 | 1,165 | 1,836 | 1,434 | 2,156 |

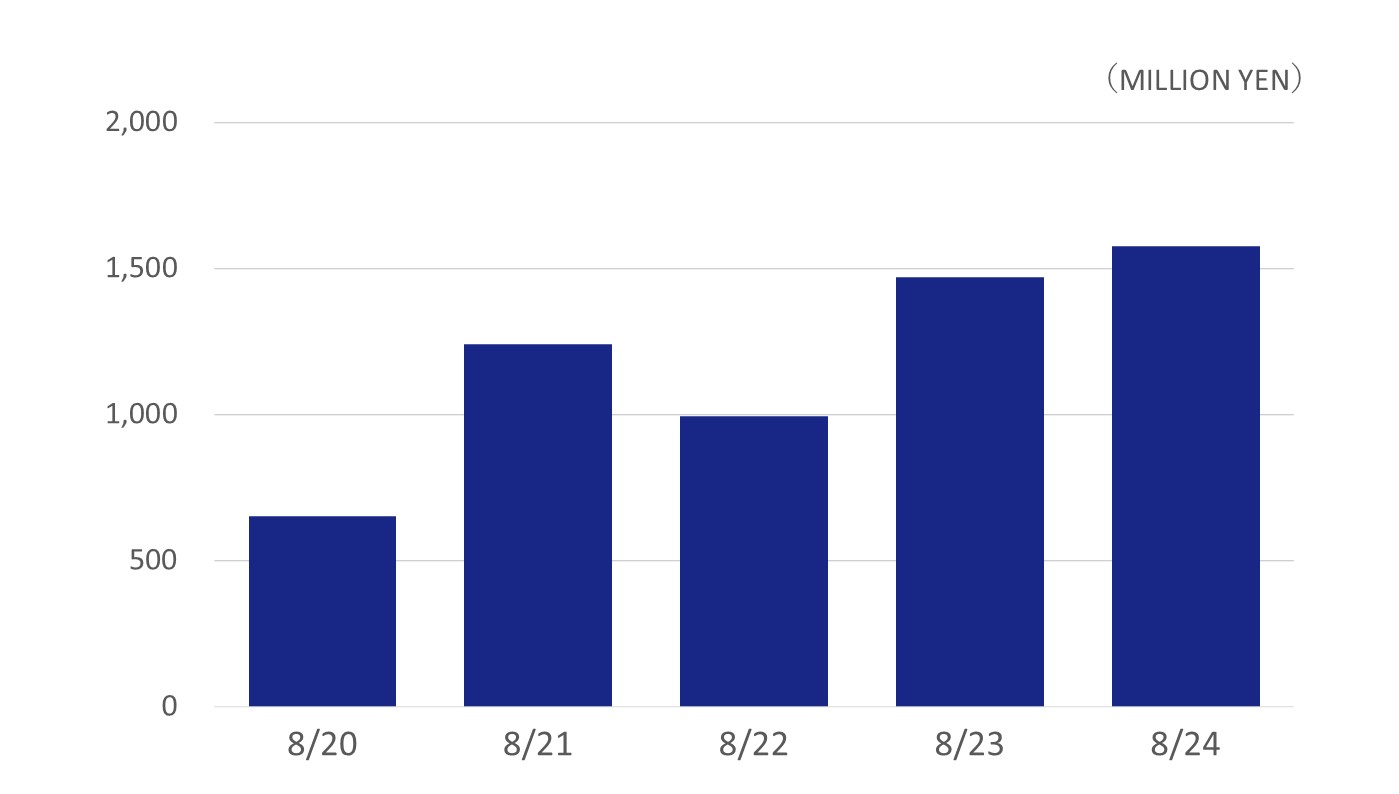

Profit attributable to owners of parent

| 8/19 | 8/20 | 8/21 | 8/22 | 8/23 |

|---|---|---|---|---|

| 440 | 654 | 1,240 | 966 | 1,472 |

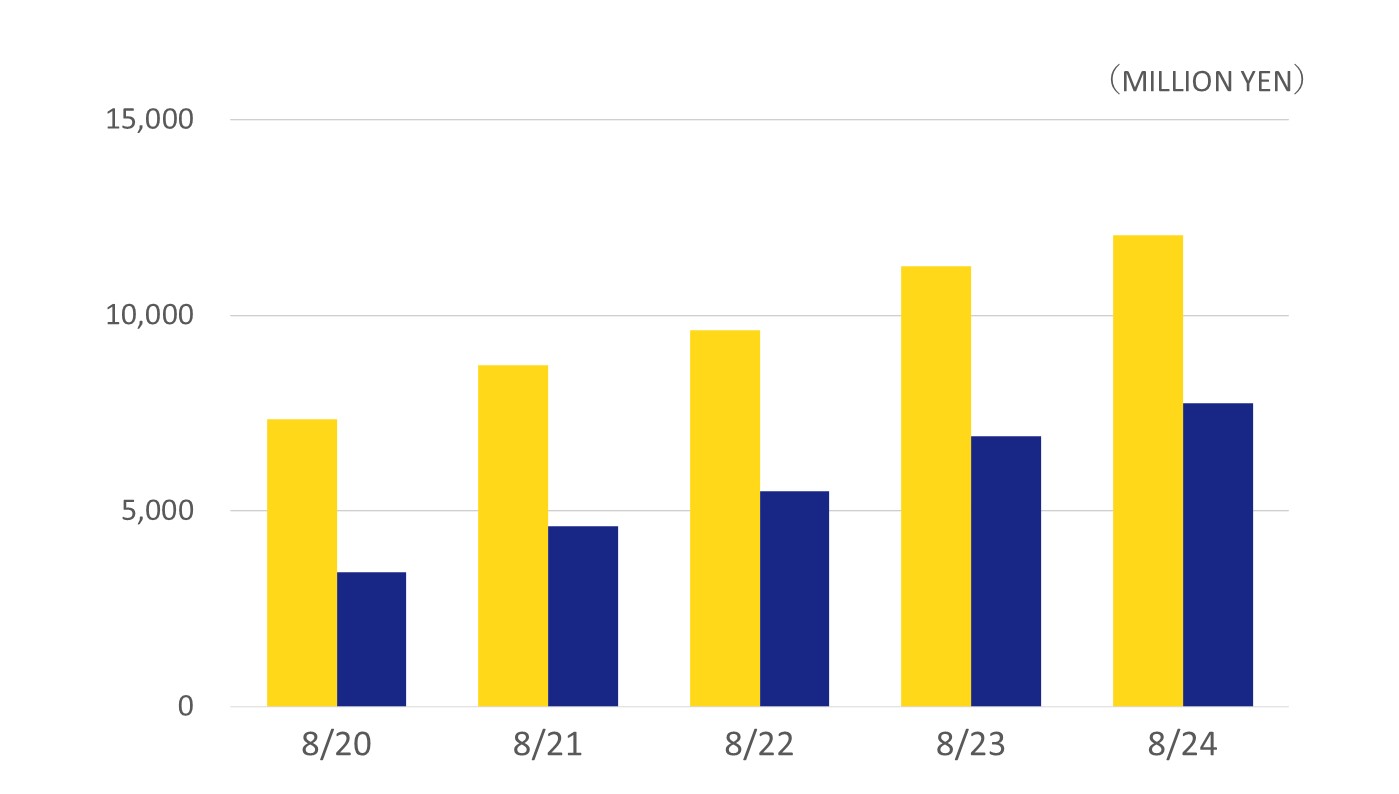

Total assets, Net assets

| 8/19 | 8/20 | 8/21 | 8/22 | 8/23 | |

|---|---|---|---|---|---|

| Total assets (MILLION YEN) |

5,370 | 7,342 | 8,730 | 9,620 | 11,253 |

| Net assets (MILLION YEN) |

2,811 | 3,429 | 4,616 | 5,519 | 6,904 |

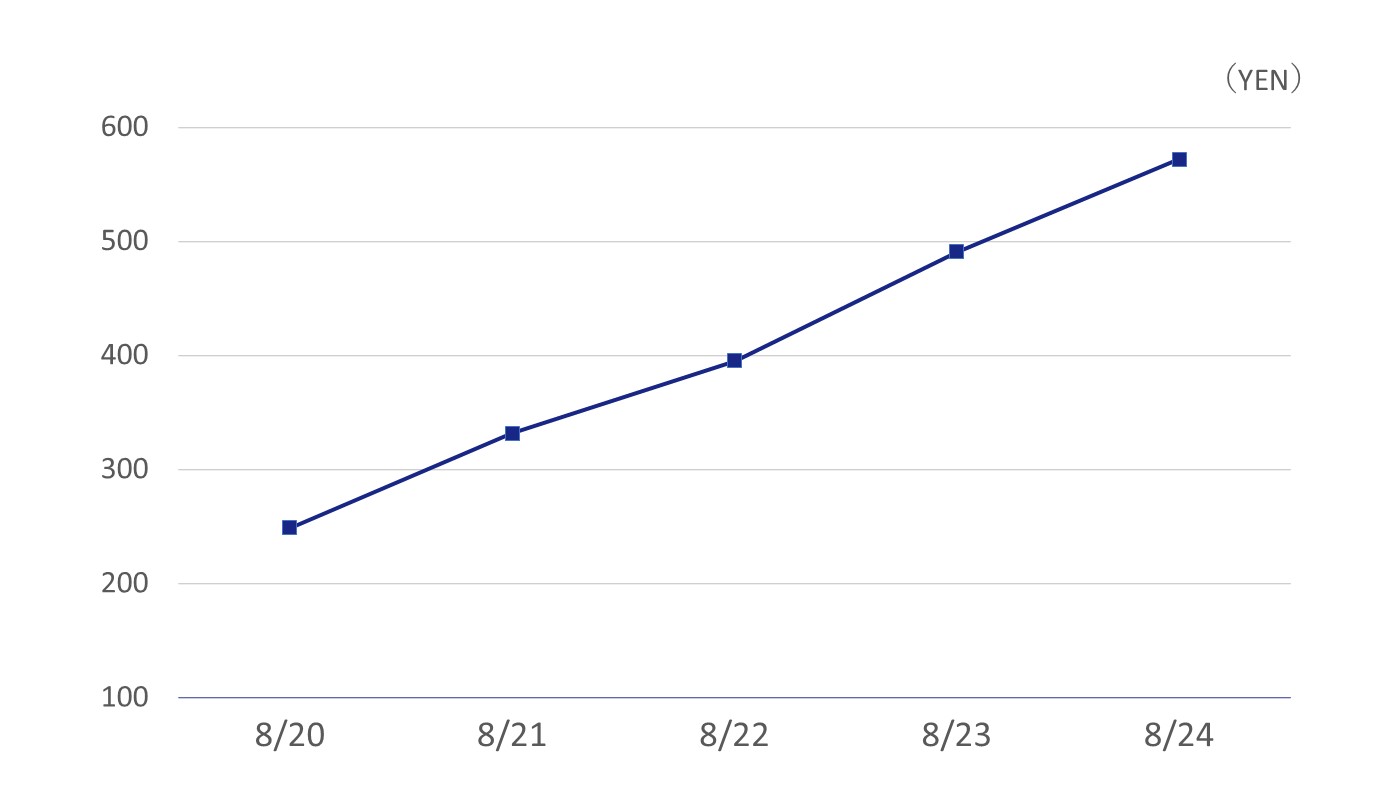

Book value per share

| 8/19 | 8/20 | 8/21 | 8/22 | 8/23 |

|---|---|---|---|---|

| 204.09 | 248.82 | 331.77 | 395.18 | 490.98 |

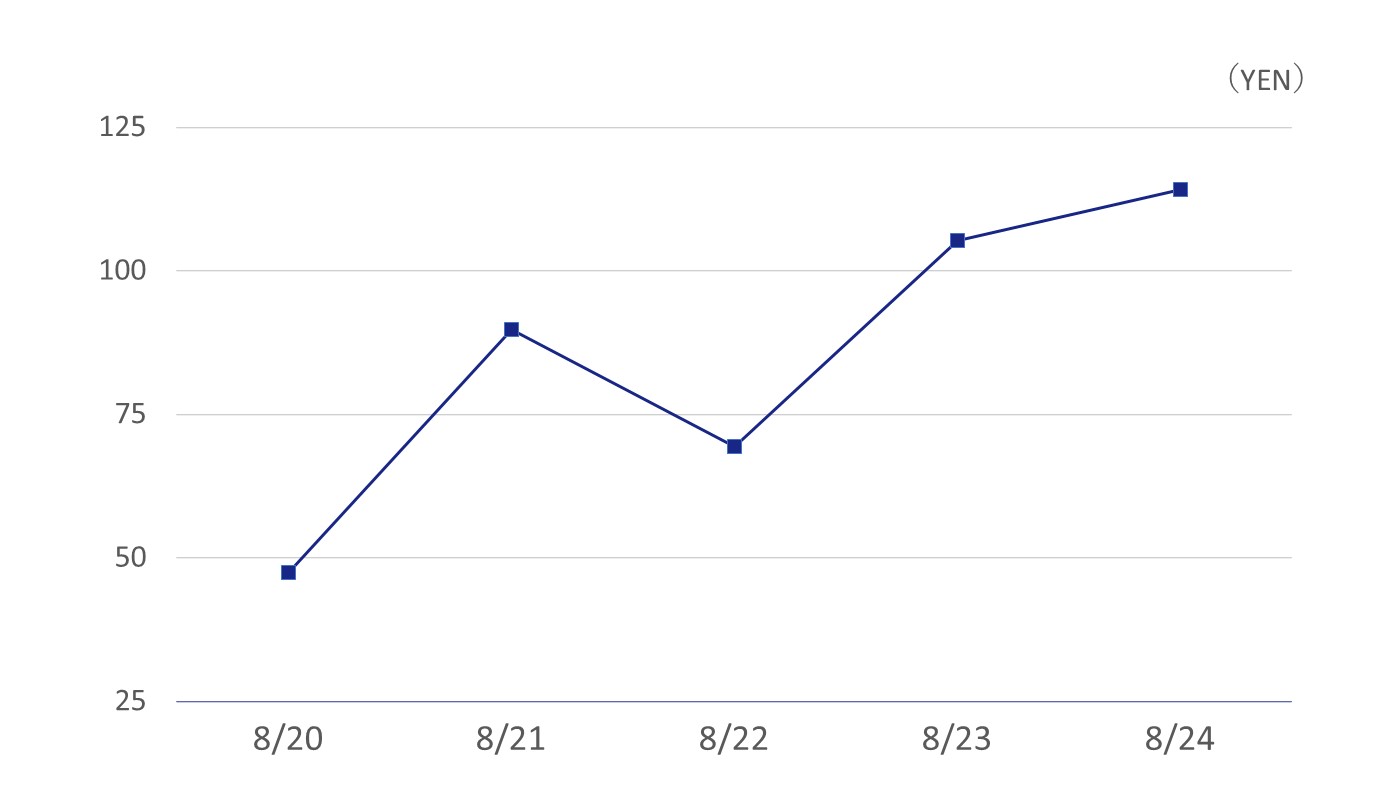

Earnings per share

| 8/19 | 8/20 | 8/21 | 8/22 | 8/23 |

|---|---|---|---|---|

| 32.03 | 47.50 | 89.82 | 69.36 | 105.35 |

- * The Company employ concatenated accounting after the fiscal year ending August 2018.

- * The Company conducted a share split at a ratio of twenty-for-one effective August 8, 2014. The Company conducted a share split at a ratio of hundred-for-one effective April 30, 2016. The Company conducted a share split at a ratio of four-for-one effective March 1, 2017. The figures for Consolidated Net Assets per Share, Net income per share are accordingly adjusted assuming.

Please note the following:

- ・This site will not be immediately updated if correction of earnings data and others are announced.

- ・Frequency of updates may vary due to changes in earnings report format.

- The data used within this site is compiled from the earnings announcements.

- In the preparation of the various data shown within this site, we make every effort to ensure its accuracy. But despite our best efforts, the possibility for inaccuracy in the data due to reasons beyond our control exists.

- For more detailed earnings information please see the Reference Material.

- The data contained within this page is provided by PRONEXUS INC.

Financial statements

(milions of yen)

FY8/19

FY8/20

FY8/21

FY8/22

FY8/23

Profit and loss statement

Sales

11,410

13,771

15,263

17,859

20,858

COGS

8,792

10,486

11,596

13,954

15,680

(COGS margin)

77.1%

76.1%

76.%

78.1%

75.2%

Gross profit

2,617

3,285

3,667

3,904

5,178

(GPM)

22.9%

23.9%

24.%

21.9%

24.8%

SG&A expense

1,890

2,150

2,311

3,017

3,233

(SG&A ratio)

16.6%

15.6%

15.1%

16.9%

15.5%

Operating profit

727

1,134

1,356

886

1,944

(OPM)

6.4%

8.2%

8.9%

5.%

9.3%

Non-operating profit

10

34

484

550

213

Non-operating expense

0

3

4

3

2

Recurring profit

737

1,165

1,836

1,434

2,156

(RPM)

6.5%

8.5%

12.%

8.%

10.3%

Extraordinary gains

0

0

0

0

0

Extraordinary losses

38

102

16

11

9

Profit before tax

699

1,063

1,820

1,423

2,147

income tax

258

409

579

456

674

(Effective income tax rate)

37.%

38.5%

31.8%

32.1%

31.4%

Net profit

440

654

1,240

966

1,472

(NPM)

3.9%

4.7%

8.1%

5.4%

7.1%

Current assets

4,480

6,315

7,496

8,260

9,725

Cash and deposits

2,772

4,329

5,458

5,658

6,867

Notes and accounts receivable

1,597

1,826

1,821

2,336

2,562

Inventories

46

56

95

86

95

Others

64

103

121

178

201

Fixed assets

889

1,026

1,234

1,360

1,527

Tangible fixed assets

86

134

199

207

222

Intangible fixed assets

62

35

22

9

2

Investments, other assets

741

856

1,012

1,143

1,302

Assets

5,370

7,342

8,730

9,620

11,253

Current liabilities

2,223

2,773

3,235

3,828

4,178

Notes and accounts payable-trade

39

57

111

159

130

Short-term loans

136

106

255

600

183

Others

2,047

2,609

2,868

3,069

3,865

Fixed liabilities

335

1,139

879

272

170

Liabilities

2,559

3,912

4,114

4,101

4,349

Shareholders' equity

2,811

3,421

4,611

5,510

6,864

Paid-in capital

297

297

304

306

307

Capital surplus

495

495

501

503

504

Retained earnings

2,018

2,628

3,805

4,700

6,052

Treasury stock

0

0

0

0

0

Own equity

2,809

3,425

4,611

5,510

6,864

Net assets

2,811

3,429

4,616

5,519

6,904

Liabilities and net assets

5,370

7,342

8,730

9,620

11,253

EPS (\)

32.0

47.5

89.8

69.3

105.4

BPS (\)

204.1

248.8

331.7

395.1

491.0

Cash flow from operations

655

995

1,467

704

2,027

Cash flow from investments

-255

-160

-186

-176

-195

Free cash flow

399

835

1,281

527

1,832

Cash flow from financing

57

724

-154

-328

-625

Cash and cash equivalents at of period

2,723

4,282

5,409

5,608

6,814

- * The Company conducted a share split at a ratio of four-for-one effective March 1, 2017. The figures for Consolidated Net Assets per Share, Net income per share are accordingly adjusted assuming.